[:en]

Caterpillar Inc. is an American corporation which designs, manufactures, markets and sells machinery, engines, financial products and insurance to customers via a worldwide dealer network. Caterpillar is the world's leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. The first quarter of 2018 reported a 31% rise in sales and revenue. They have also repurchased $500 million of their own shares.

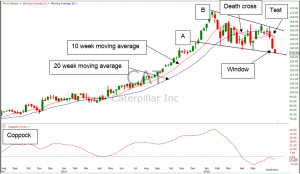

- The death cross (negative) was confirmed when the short 10 week moving average (blue line) crossed through the longer 20 week moving average (red line). This is seen as negative.

- The 10 week moving average tested the 20 week moving average but was not strong enough to break to the upside which is seen as negative.

- Line A ($135-18) is a strong support and if this line doesn’t remain a support, things can get ugly.

- The coppock indicator also couldn’t change the signal line into a support which is seen as negative.

- The share is in oversold territory which means it can easily bounce from here but if the share doesn’t change line B ($155-23) into a support things can get ugly.

- Above line B the falling wedge can take the share to a new record high of $178 should the formation play out.

- A window is waiting between $138-98 and $139-12.

- For traders – Buy above $136-58 but use $133-70 as stop loss to protect capital. The possible targets towards the top are $138-98, R139-12, $143-90 and $146-12.

- For medium to long term investors – Use every rally in the share price to reduce exposure to the share as long as the 10 week moving average remains a resistance on the 20 week moving average.

Don't hesitate to ask if anything is unclear.

Frans & Christelle

[:AF]Caterpillar is die wêreld se vooraanstaande vervaardiger van konstruksie en mynbou toerusting, diesel en aardgas enjins, industriële gas turbines en diesel-elektriese lokomotiewe. Hulle verkoop ook finansiële produkte en versekering aan hulle kliënt via ‘n wêreldwye netwerk. In hulle eerste kwartaal resultate vir 2018 het is ‘n 31% toename in verkope gerapporteer. Hulle het ook $500 miljoen van hulle eie aandele teruggekoop.

- Die “dooie kruis’ (negatief) fenomeen is bevestig toe die kort 10 week bewegende gemiddelde (blou lyn) deur die langer 20 week bewegende gemiddelde (rooi lyn) gekruis het. Dit word as negatief beskou.

- Die 10 week bewegende gemiddelde het die 20 week bewegende gemiddelde is voorheen getoets, maar was nie sterk genoeg om na bo te breek nie dit word as negatief gesien.

- Lyn A ($135-18) is ‘n steun en as hierdie lyn nie 'n steun bly nie kan die afverkoop toeneem.

- Die coppock aanwyser kon ook nie die seinlyn na bo breek nie. Dit word as negatief beskou.

- Die aandeel is oorverkoop wat beteken dit kan maklik ‘n herstel lopie inlui, maar as die aandeel nie lyn B ($ 155-23) verander in 'n steun nie, bevestig dit net meer swakte.

- Bo lyn B kan die dalende wig die aandeel na 'n nuwe rekord hoogtepunt van $178 neem indien die formasie sou uitspeel.

- 'n Venster wag tussen $138-98 en $139-12.

- Vir spekulante - Koop bo $136-58 slegs indien u hoop op ‘n herstel lopie, maar gebruik $133-70 as keerverlies om kapitaal te beskerm. Die moontlike teikens na bo is $138-98, $139-12, $143-90 en $146-12.

- Vir medium tot langtermyn beleggers - Gebruik elke bons in die aandeelprys om blootstelling aan die aandeel te verminder solank as wat die 10 week bewegende gemiddelde 'n weerstand van die 20 week bewegende gemiddelde bly.

Laat weet indien daar enige vrae is.

Frans & Christelle[:]