[:en]Lonmin is a British producer of platinum group metals operating in the Bushveld. Thy are listed in London and in South Africa. On Tuesday the CMA (British Competition and Markets Authority) said they would examine whether a takeover by Sibanye-Stillwater would lessen the competition. If this takeover deal of R4bn continues Sibanye-Stillwater would be the second largest platinum producer in the world. Lonmin needs R1bn per month to run their business. Yesterday the Reserve Bank gave their approval for the buyout. Their second quarter production report, reported a 12.4% rise in unit cost for the quarter, which is primarily driven by the 8% increase in wages.

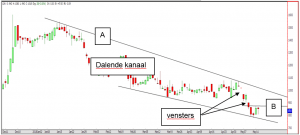

- The share is caught within a descending channel (possible positive).

- The formation will be confirmed above line A (R8-83) which can take the share to R11-86 should the formation play out.

- First sign of strength will be visible above line B (R8-74) and if the strength in the share price remain the share can try to close the windows between R9 and R9-03 and between R9-73 and R10-18 and between R10-18 and R10-33.

- Below R8-04 the optimism will be off the table.

- For traders – Nibble above line B, increase exposure above line B but use R8 as stop loss to protect capital. The possible targets are the windows as given above.

- For medium to long term investors – Let’s wait patiently for more certainty on the graph.

Let us know if there are any questions.

Frans & Christelle de Klerk[:AF]Lonmin is 'n Britse vervaardiger van platinumgroepmetale wat in die Bosveld bedryf word. Hulle is genoteer in Londen (FTSE) en in Suid-Afrika (JSE). Die afgelope week het die CMA (British Competition and Markets Authority) genoem dat hulle ondersoek instel of die oorname deur Sibanye-Stillwater die kompetisie sou verminder binne die sektor. As hierdie oorname van R4 biljoen sou voortgaan, sal Sibanye-Stillwater die tweede grootste platinumprodusent ter wêreld word. Lonmin benodig R1 biljoen per maand om hul besigheid te bedryf. Die Reserwe Bank het ook ook die afgelope week hulle toestemming gegee vir die oorname. In hul tweede kwartaal se produksieverslag het hulle 'n styging in eenheidskoste van 12,4% vir die kwartaal gerapporteer, wat hoofsaaklik deur die loonverhoging van 8% gedryf word.

- ‘n Hoog spekulatiewe geleentheid wag dalk in Lonmin.

- Die aandeel is vasgevang in ‘n dalende kanaal (moontlik positief).

- Bo lyn A (R8-83) kan die kanaal na bo breek en die aandeel na R11-86 neem indien die formasie na bo sy teiken bereik.

- Bo lyn B (R8-74) kan die aandeel dalk spekulante se oog vang en ‘n poging aanwend om die vensters tussen R9 en R9-03 en tussen 9-73 en R10-18 en R10-18 en R10-33 aan te durf.

- Onder R8-04 sal die positiwiteit van die tafel verdwyn.

- Vir spekulante - peusel bo lyn B, verhoog blootstelling bo lyn A, maar gebruik R8 as keerverlies om kapitaal te beskerm. Die moontlike teikens na bo is die venster soos bo deurgegee.

- Vir medium tot langtermynbeleggers – kom ons wag geduldig vir meer duidelikheid op die grafiek.

Laat weet indien daar enige vrae is.

Frans & Christelle de Klerk

[:]