[:en]MTN is the second largest telecommunications company in South Africa according to market capitalization. The quarterly update (March 2018) for the group reported a 1.9% increase in subscribers on a quarter-on-quarter basis. Active mobile customers increased by 3.9% to 22.7 million subscribers. MTN South Africa increased service revenue by 2.5% and MTN Nigeria increased service revenue by 14.4%.

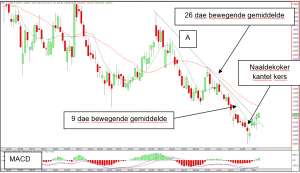

- Line A (R107-90) which has kept the momentum to the bottom in place since May 2018

- has changed into a support which is seen as positive.

- The MACD has also turned upwards which is seen as positive.

- The dragonfly candle (positive) implies that the buyers have started to nibble on the share in weakness.

- It seems as if the 9 day moving average (green line) wants to turn upwards. A break of the 9 day through the 26 day moving average (red line) will confirm a golden cross which will confirm optimism.

- For traders – Buy above R110-50 but use R102 as stop loss to protect capital. The possible targets towards the top are R111-80, R113-35, R114-62, R115-90, R117-70 and R120.

- For medium to long term investors – The share is still consolidating below its 40 week moving average (R123-82) on a weekly graph which is seen as negative. Only above this level will we start to feel comfortable for the medium to long term again.

Let us know if there are any questions.

Frans & Christelle[:AF]MTN is die tweede grootste telekommunikasiemaatskappy in Suid-Afrika, volgens markkapitalisasie. Die kwartaallikse opdatering (Maart 2018) vir die groep op 'n kwartaal tot kwartaal basis het 'n toename van 1,9% in intekenare gerapporteer. Aktiewe mobiele kliënte het met 3,9% toegeneem tot 22,7 miljoen intekenare. MTN Suid-Afrika het diensinkomste met 2,5% verhoog en MTN Nigerië het diensinkomste met 14,4% toegeneem.

- Lyn A (R107-90) wat die momentum na onder in plek gehou het, het in ‘n steun verander wat as positief beskou word.

- Die MACD het ook opwaarts gedraai wat as positief beskou word.

- Die naaldekoker kers (positief) impliseer dat die kopers in swakte aan die aandeel begin peusel het.

- Dit lyk asof die 9 dae bewegende gemiddelde (groen lyn) opwaarts wil draai. 'n Breek van die 9 dae deur die 26 dae bewegende gemiddelde sal 'n goue kruis bevestig wat optimisme sal bevestig.

- Vir spekulante - Koop bo R109-20 maar gebruik R102 as keerverlies om kapitaal te beskerm. Die moontlike teikens na bo is R111-80, R113-35, R114-62, R115-90, R117-70 en R120.

- Vir medium tot langtermynbeleggers - Die aandeel konsolideer nog onder sy 40 week bewegende gemiddelde (R123-82) op 'n weeklikse grafiek wat negatief beskou word. Slegs bo die gemiddelde sal ons weer gemaklik voel vir die medium tot lang termyn.

Laat weet indien daar enige vrae is.

Frans & Christelle

[:]