[:en]Steinhoff continues to make news headlines with the amount of irregularities and fraudulent activities. Earlier this week it was reported that Steinhoff bought forest plantations in 2001 that were linked to executives and sold them three years later to the retailer for more than five times their original value. The forestry deal is similar to car dealership transactions Steinhoff carried out in 2007 where it bought properties from companies linked to Markus Jooste at a multiple of their initial value.

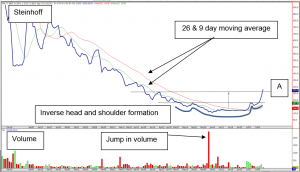

- The amount of shares (241 million) that traded around R1-28 / R1-35 caught the eye. The jump was only possible through willing buyers and willing sellers.

- An inverse head and shoulder formation was visible and also played out. An inverse head and shoulder is seen as a turn-around pattern after a share experienced a lot of pressure.

- The 26 and 9day moving averages have crossed one another to the upside which confirms the mediumterm strength in the share price.

- For traders - if you already own the shares, hold on as long as the share consolidates above line A (R2-65). If you want to chase the momentum buy as close as possible to line A but use R2-24 as stop loss to protect capital. If the share can consolidate above R3 we can see the share at R3-40 in time to come.

- For medium to longterm investors - If you already own the share, do the same as traders above, but keep in mind, it is still an extremely risky share considering that there are many uncertainties to still resolve.

Don't hesitate to ask if anything is unclear.

Kind regards

Frans & Christelle[:AF]Steinhoff haal voortdurend die nuusopskrifte met die hoeveelheid onreëlmatighede en bedrieglike aktiwiteite wat in die maatskappy ontbloot word. Vroeër hierdie week is daar berig dat Steinhoff in 2001 bosplantasies gekoop het wat aan uitvoerende hoofde gekoppel is en drie jaar later verkoop is vir meer as vyf keer hul oorspronklike waarde. Die “bosbou” ooreenkoms is soortgelyk aan die motorhandelstransaksies wat Steinhoff in 2007 uitgevoer het, waar eiendomme van maatskappye wat aan Markus Jooste gekoppel is, teen 'n veelvoud van hul aanvanklike waarde gekoop het.

- Die volume aandele (241 miljoen) wat verhandel is rondom R1-28/R1-35 vang die oog. Die sprong in aandele is duidelik sigbaar op die grafiek is. Om die sprong moontlik te maak, moes daar ‘n gewillige koper en ‘n gewillige verkoper was.

- 'n Omgekeerde kop en skouer formasie is sigbaar en het klaar uitgespeel. ‘n Omgekeerde kop en skouer is gewoonlik ‘n “omdraai” formasie nadat ‘n aandeel sleg onder druk was.

- Die 26 en 9 dae bewegende gemiddelde het intussen gekruis en terwyl die gemiddeldes na bo geskruis is, beteken dit dat ons mediumtermyn sterkte in die aandeelprys kan verwag.

- Vir spekulante – indien u alreeds van die aandele besit, klou vas terwyl die aandeel bo lyn A (R2-65) konsolideer. Indien u die momentum na bo wil jaag, koop so na as moontlik aan lyn A maar gebruik R2-24 as keerverlies om kapitaal te beskerm. Indien die aandeel bo R3 kan konsolideer, kan die aandeel dalk na R3-40 oor tyd.

- Vir medium tot langtermyn beleggers - As u reeds die aandeel besit, doen dieselfde as spekulante hierbo, maar hou in gedagte, dit is nog steeds 'n uiters riskante aandeel om te oorweeg, aangesien daar baie onsekerhede is wat nog opgelos moet word.

Laat weet indien daar enige vrae is.

Frans & Christelle de Klerk[:]