[:en]Transhex is a diamond mining company. Trans Hex Diamond Cutting Works is a black-empowered cutting and polishing factory of which they have a 75% interest in. According to their interim 2017 results the net asset value per share is R1-42. The group’s net loss amounted to R199m while for the same period in 2016 they reported a profit of R32,5 million. On the 29th of March they made a cautionary announcement, warning shareholders that they are in negotiations that might have a material impact on the share price.

- After some serious profit taking since the beginning of the year, the share has started to build on a consolidation base. This consolidation implies that shareholders are happy with the current affairs and if the negotiations go as planned the share price can easily rise.

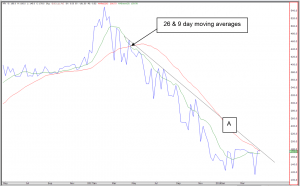

- The 26 & 9 day moving averages confirm that the momentum to the bottom is still clearly in place but it is evident that the 9 day moving average is curving to the upside and if the share continues to reach for higher levels, the 9 day would probably break through the 26 day which will signal a buy for the medium to long term investors.

- Line A (R1-78) which has remained a resistance since April 2014 has also been tested.

- For traders – Buy above line A but use R1-14 as stop loss to protect capital. The possible targets towards the top are R2, R2-31, R2-64 and R3-05.

- For medium to long term investors – Wait for the 26 & 9 day moving averages to cross one another to the upside and start to accumulate then but below R1-11 the technical graph will warn again.

Let us know if there are any questions.

Kind regards

Frans & Christelle[:AF]

Transhex is 'n diamantmynmaatskappy. Trans Hex Diamond Cutting Works is 'n maatskappy waarvan die meeste aandeelhouers (75%) uit voorheen benadeeldes bestaan. Hulle fokus op die sny en poleer van diamante. Volgens hul tussentydse 2017 resultate is die netto batewaarde per aandeel R1-42. Die groep se netto verlies het R199 miljoen beloop vir die ses maande tot einde September, terwyl hulle ‘n wins van R32,5 miljoen gerapporteer het vir dieselfde periode in 2016. Op die 29ste Maart het hulle ‘n waarskuwing uitgereik aan aandeelhouers dat hulle besig is met onderhandelinge wat ‘n wesenlike impak kan hê op die aandeelprys.

- Na erge winsneming, konsolideer die aandeel sedert die begin van 2018. Die konsolidasie gee die gedagte deur dat beleggers tevrede is met die huidige stand van die aandeelprys en indien genoemde samesprekings gunstig is, kan die aandeelprys maklik kop optel.

- Die 26 en 9 dae bewegende gemiddeldes bevestig dat die momentum na onder nog duidelik in plek is, maar dit is duidelik dat die 9 dae bewegende gemiddelde na bo begin draai. As die aandeel aanhou om na hoër vlakke te reik sal die 9 dae bewegende gemiddeld waarskynlik deur die 26 dae breek wat 'n koop vir medium- tot langtermynbeleggers sal aandui. Dit sal as tegnies positief gesien word, want die kruis van die 2 gemiddeldes kan mediumsterkte in die aandeelprys vooruitloop.

- Lyn A (R1-78) wat sedert April 2014 'n weerstand gebly het, is ook getoets.

- Vir spekulante - Koop eers bo lyn A, maar gebruik R1-14 as keerverlies om kapitaal te beskerm. Die moontlike teikens na bo is R2, R2-31, R2-64, R2-76, R2-93 en R3-05.

- Vir medium- tot langtermynbeleggers - Wag vir die 26 en 9 dae bewegende gemiddeldes om mekaar te kruis, en begin dan akkumuleer, maar hou in gedagte onder R1-14 sal die tegniese grafiek weer waarsku. Gebruik dus R1-14 as keerverlies om kapitaal te beskerm.

Laat weet indien daar enige vrae is.

Groete

Frans & Christelle

[:]